First Published in IRRV Insight December 2018 edition.

First Published in IRRV Insight December 2018 edition.

Readers will no doubt be aware of government plans to increase the level of council tax premiums that councils may apply to properties that have been unoccupied and unfurnished for two years or more. If fact, it may well be the case that by the time this article is published government proposals to introduce a discretion for councils to levy a premium of up to 100% for properties that have been empty for two years or more may have already passed into legislation. Additionally, the government is also proposing premiums in subsequent years of up to 200% for properties empty for five years or more and up to 300% for properties empty for ten years or more.

The aim of this policy, in the words of the Secretary of State for Communities the Rt Hon James Brokenshire MP, is to ‘incentivise owners to bring long-standing empty homes back into use’. The MHCLG have further stated that councils that have applied the premium consistently every year have seen a nine per cent fall in the number of homes being charged the premium.

Council Tax charges for long term empty properties

Historically, properties that were unoccupied and unfurnished for over six months received a 50% council tax discount. In 2004 the government granted councils the discretion to either reduce or remove this discount and in 2013 the discretion to charge a council tax premium of up to 50% for properties that had been unoccupied and unfurnished for more than two years was introduced.

However, what is less clear is whether there has been a causal link between councils that have exercised these discretions and any corresponding reduction in the numbers of long term empty homes. In 2012, immediately prior to the introduction of the 50% premium, I researched the short term impact on the numbers of properties that had been empty for six months or more at councils that had decided to remove the 50% discount on these properties.

In light of the proposed increases to the level of premiums that councils may apply, it is an appropriate time to look again at the outcome of this research. Whilst there may be differences to the findings in respect of any outcomes from increasing the levels of premium that are charged, readers may wish to take into account the impact on long term empty property numbers that removing the 50% discount had.

Methodology

The Council Taxbase (CTB) form which councils complete and return to government during the first week of October each year was used as the basis for the research. By comparing the returns for October 2010 and October 2011 it was identified that 13 councils had decided to reduce the 50% long term empty discount to zero in April 2011. The CTB form was also used to identify any changes in the numbers of long term empty properties at these councils between October 2010 and October 2011.

The research then used the CIPFA Nearest Neighbours Model which compared 30 variables including demographics, population and ethnicity to identify councils that were most similar to the 13 councils identified from the CTB form as having removed their 50% long term empty discount. In effect, it was possible to use these councils as comparator councils and identify what the situation would have been if the original 13 councils had not chosen to reduce their level of discount.

The CTB dataset held by DCLG was then checked for each nearest neighbour to ascertain whether they had already removed the discount or not. If they had already removed the discount, then the next nearest neighbour was considered. This process continued until a neighbour who had not yet removed the discount was identified.

The impact upon single occupancy discounts

Many Revenues Managers had traditionally expressed an opinion that any reduction in the numbers of empty properties that may have occurred as a result of changes to the amount of council tax charged on those properties, could result in a subsequent increase in the number of single occupancy discounts at those councils as taxpayers sought to mitigate their liability.

The CTB dataset was once again used to obtain the numbers of single occupancy discounts that were in place at the 13 councils and their comparators in October 2010, and the numbers of discounts in place in October 2011 following implementation of the increased charges for empty homes.

Results and Findings

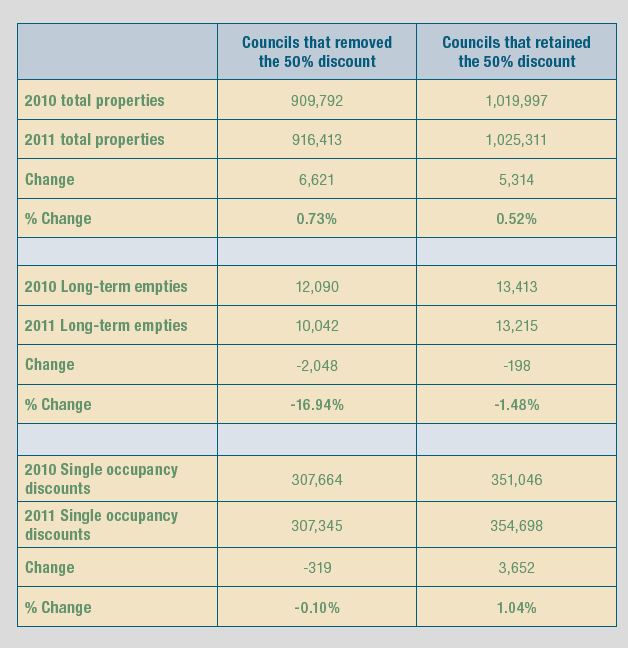

The table below compares the property figures obtained from the CTB dataset for those councils that removed the 50% empty property discount in April 2011 against those that retained the discount.

It can be seen that there was an increase in the total number of properties across both groups of councils during the course of the year, and that these increases were not dissimilar with increases of 0.73% and 0.52% respectively.

Both groups of councils also saw a reduction in the number of properties that had been empty for more than six months. However, the reduction of 2,048 properties was far greater at those councils that had removed the discount than the reduction of 198 at those councils that had retained the discount. In percentage terms the number of long term empty properties at councils that removed the discount reduced by 16.94%, whilst there was a reduction of 1.48% at those councils that retained the discount.

As discussed earlier, the next step was to look at the number of single occupancy discounts at the two groups of councils to consider whether any reduction in empty properties had been offset by an increase in the numbers of these discounts. The councils that had removed the empty discounts saw a reduction of 319 discounts which represented 0.10%, whilst the councils that had retained the empty homes discounts actually saw an increase in single discounts of 3,652 or 1.04%. As a Revenues Manager myself at the time I must admit to being surprised at this particular finding!

Conclusions

The results from this research suggest that the short term impact of increasing the amount of council tax payable for empty properties is that there is a reduction in the number of long term empty properties and that the identified reduction of 16.94% is significant. Additionally, from this research there is no evidence of a reduction in the number of empty properties resulting in an increase in the number of properties that receive a single occupancy discount over the short term.

As stated earlier, this article has looked into the short term impact that reducing the level of empty homes discount in 2011 had on the volume of empty properties at that time. Therefore, further research into the longer term impact of increasing the amount of council tax charged for long term empty properties would be welcomed. In particular, with respect to the impact of increasing the levels of premiums and understanding the extent to which these changes account for reductions in the numbers of empty properties.