With Council Tax arrears increasing by £213m, (an additional 7%) rising up to £3.2bn going into the 2019-20 financial year, a Councils ability to judge the recoverability of the debt and the next best course of action to collect that debt is becoming increasingly important. More so when it comes to balancing Council budgets and planning expenditure for the year ahead whilst balancing the demands of fulfilling statutory obligations.

Following conversations with numerous Local Authorities on this very topic we have developed a ‘Data Services’ solution designed to provide financial insights at an individual debtor level so that Councils can decide what action needs to be taken and the likelihood of the debt being collected.

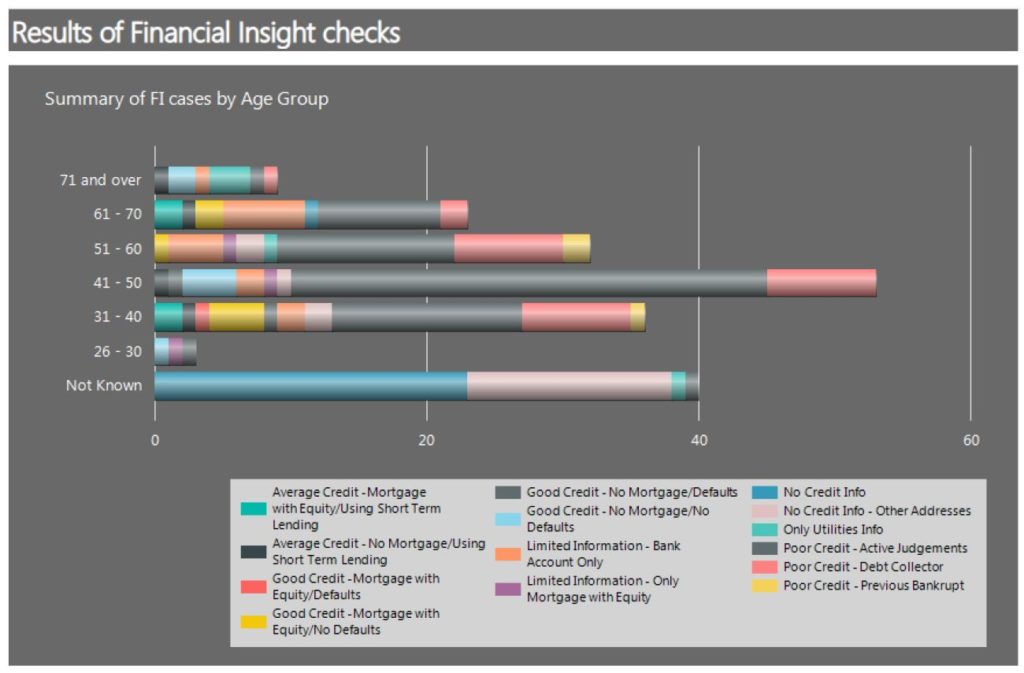

It works by collecting details of Council debtors from their systems and automates the process of undertaking financial checks on those debtors. This information is then fed back into the Council through access to a secure, centralised portal incorporating graphs and reports so that at a glance, Councils can view the overall collectability of the debt. It also enables Councils and the enforcement partners working on their behalf to drill down into an individual debtor to see their full financial records. Typical debtor financial information provided includes mortgage values alongside equity, credit card balances, outstanding loans and hire purchases as well as addresses linked to the individual. This is particularly useful when trying to assess the next best actions to take, as is the ability to customise the view of the financial insights which appear, so that Councils can prioritise which debts they wish to focus on.

Designed to streamline the process of council debt collection, your enforcement and recovery specialists will be in a position to make more informed decisions, backed up by sound financial data about the debtor’s worth pursuing that are most likely to pay. Similarly, quite early on in the process provisions can be made for those who look unlikely to be able to pay based on their current financial situation.

Councils will be effectively provided with a tool which helps demonstrate their ability to fairly administer their recoveries activity taking into account a person’s individual set of circumstances. From a customer service perspective, it is a game-changer, highlighting that some thought and consideration has been taken before pursuing a debt.

The ‘Data Services’ solution is also available for the collection of business rates debt and enabling Authorities to drill down into financial details relating to a business’s activities and the Directors associated with those businesses.

Come along and speak to our team at the IRRV conference on Stand 19 to find out more about recoverability of Council debt, alternately email info@destin.co.uk for more details.