It is our experience that many Local Authorities have a significant amount of Council Tax, Business Rates and other sundry debt accounts placed ‘on hold’ and in some cases this may have been in place for a number of years. What does this actually mean? It means that for any number of reasons the collection or recovery process has been halted and Council revenue owed will not be received until this ‘hold’ has been lifted.

Questions to ask to increase your chances of revenue recovery

Do you know within your own Authority how much revenue is currently on hold, do you know the reason for that hold being in place and who in your authority authorised it? If you don’t have ready access to this data it makes it more likely that those revenues will never be recovered. There are so many other processes and areas to be administered and with constant cut backs it can be difficult to review those areas or processes which get caught between the gaps.

Implications of the Limitation Act

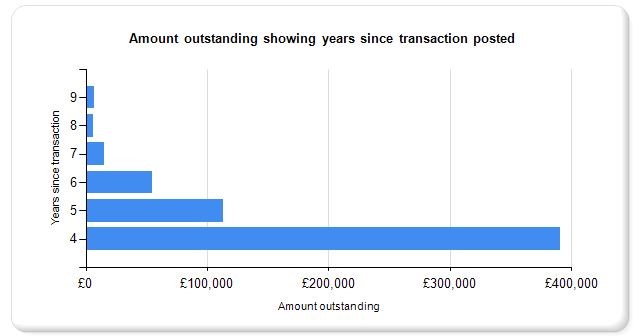

Further exacerbating the situation is the Limitation Act of 1980 which, in part, relates to time limits placed on the recovery of debt and states that any action to recover a sum must be started within 6 years of the amount becoming due. How much of your revenue has been on hold for just under six years? Assuming you can easily access and review information related to your ‘on hold’ accounts – has anyone been tasked with re-investigating these accounts to find out if the hold can be lifted and the debt recovered before they become “statute barred”?

Debt data reporting tools that can help

This does not have to be a complex task as there are debt reporting tools available which collate data from a number of large business systems such as your Council Tax, NNDR, Housing Benefits Overpayment, and Sundry Debt applications. Using sophisticated reporting algorithms, this technology can pull together all of your debt data to identify at a glance how many of your accounts are on hold, the value of these accounts, how long they have been on hold for and the reason given for the hold being in place.

Typical reasons given for council revenue being ‘on hold’

Typical reasons accounts are put on hold include disputes about liability for payment, the debtor being deceased or bankruptcy or liquidation proceedings taking place. In some cases, the Citizens Advice Bureau may have asked for action to be suspended whilst they assist debtors with a repayment plan. There are also instances where debtors abscond without leaving a forwarding address and trace action is being undertaken. It may also be the case that the sale of a debtors property is imminent and the debt is to be paid out of the sale of the property.

Whilst all of these are legitimate reasons to put a case on hold this should only be for a finite period of time, which will vary depending on the reason for the hold. The key is to ensure that these cases are regularly reviewed and don’t get ignored because staff find them more complex and time-consuming to deal with.

With technology advancements today automated alerts can be quickly and easily put in place for different ‘on-hold’ types using workflow tools to set the parameters of when you want alerts to appear, who they should be sent to and the information they should contain. It would also be helpful at this stage to have clearly documented procedures for how to proceed with moving ‘on hold revenue’ to the next stage depending on why it was put on hold in the first place.

Drilling down into the detail

You should also factor in that staff members who initiated the ‘hold’, may have moved on to a different role, may be uncomfortable dealing with debtor confrontation and require more training or are so overworked in other areas they have had little time to re-visit their ‘on hold’ accounts. In some cases, it may be worth considering introducing special incentives to try and stimulate more proactive monitoring and review of ‘on hold’ cases by your staff.

At a strategic level, the more information your authority has about ‘on hold’ accounts the more likely you will be to spot specific trends and patterns which could indicate performance issues with either staff, processes or technology.

In a time of increasing government cuts and many councils struggling to effectively balance budgets, reducing the amount of debt written off and ‘on hold’ has to be a key part of any future financial planning and there are tools ready and available in the market today to help make this happen.

Don’t lose out on revenue by not having the necessary information at your fingertips contact Destin Solutions on 01772 842092 or email info@destin.co.uk for more details.