Following CIPFA’s observations late last year that business rates accounted for one of the largest growing areas of fraud in Local Government, Destin Solutions wanted to find out more about how Councils were tackling this.

Percentage of Authorities proactively tackling business rates fraud

Thirty Local Authorities responded to a survey we prepared in December 2018, providing some interesting insights. Of the thirty-four responses we received across these Authorities 73% of them are proactively trying to identify instances of fraud. For those that are not taking a proactive approach 70% of them noted that this was down to ‘resourcing issues’.

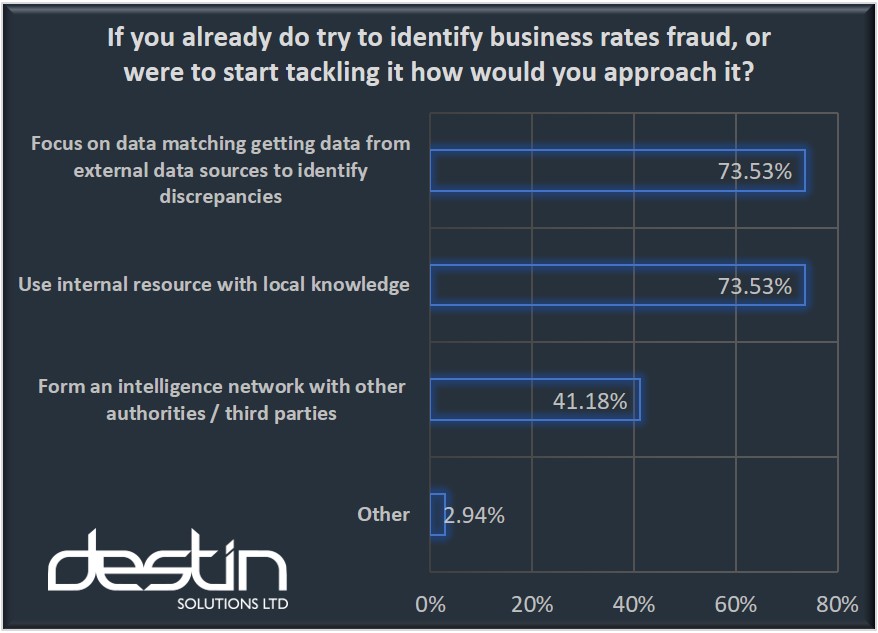

Approach to tackling business rates fraud

The survey went on to ask what approaches Councils were taking to tackle business rates fraud with the two most popular responses given as; ‘using internal resource with local knowledge’ and ‘focussing on data matching by using external data sources to identify discrepancies’. 73% of respondents cited both of these approaches. 41% of respondents also cited ‘forming an intelligence network with other authorities/third parties.’

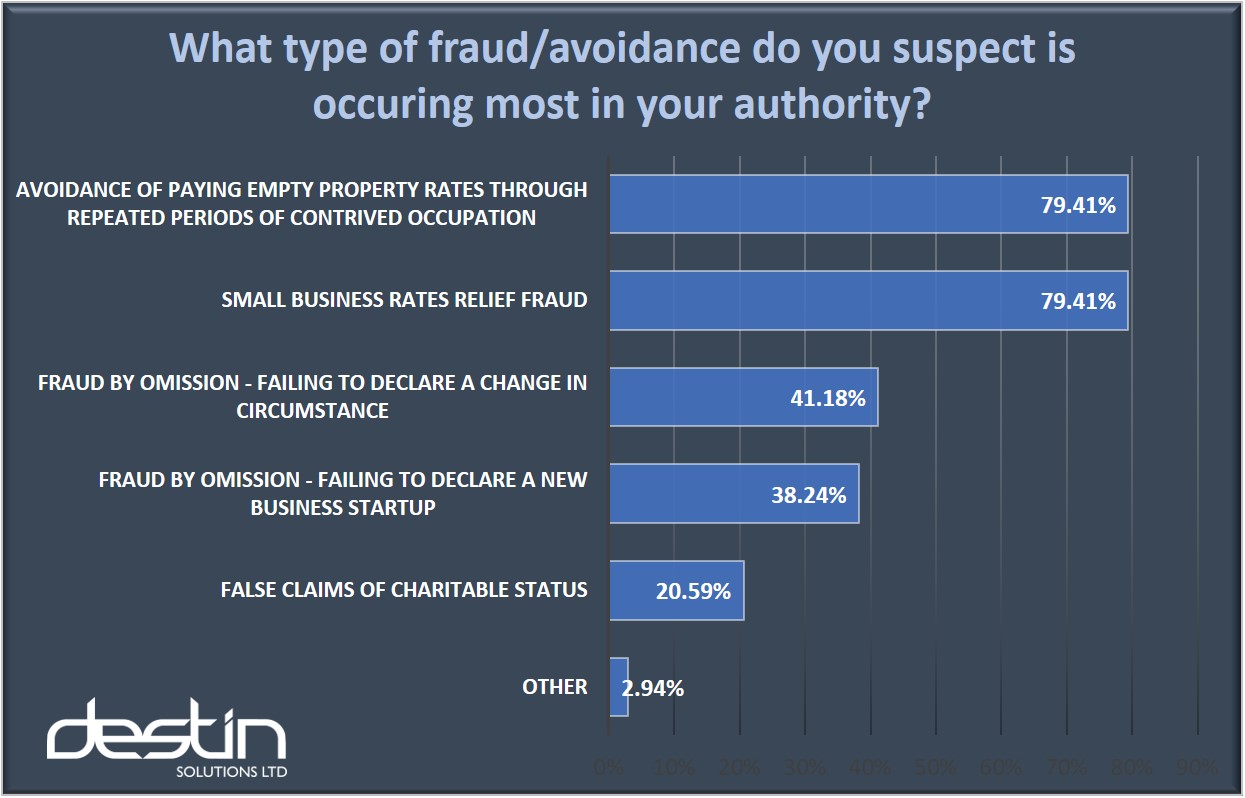

Types of business rates fraud being perpetrated

According to a 2014 business rates avoidance discussion paper issued by DCLG business rates fraud can be perpetrated in a number of ways ranging from ‘fraud by omission – such as failing to declare a change in circumstances’ to ‘false claims of charitable status’. When asked what type of fraud respondents suspected was occurring most within their own Authority both ‘small business rates relief fraud’ and ‘avoidance of paying empty property rates through repeated periods of contrived occupation’ were believed to be most prevalent. 79% of respondents cited both of these types of fraud. Another type of fraud not accounted for in the survey was also provided by a respondent citing ‘umbrella companies being used to attract the business rates liability, whilst sheltering the actual trading company from the charge.’

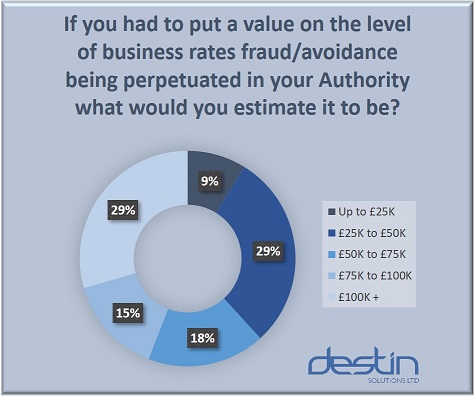

Value of business rates fraud being perpetrated in an Authority

When asked to put a value on the level of business rates fraud respondents felt was occurring in their own Authority responses showed more variance with nearly a third stating between ‘£25,000 to £50,000’ and another third believing the figure to be higher at ‘£100,000 plus’.

Industry Opinion

Alistair Townsend, Director of Public Sector Revenues at Wilks Head & Eve commented “with Business Rates Retention and the pressure on local authority budgets generally, it is unsurprising to find authorities taking extra steps to ensure the correct application of reliefs and exemptions. The true level of incorrect awards is almost impossible to calculate and the figures quoted, if anything, are likely to be understated. Whilst it is always important to differentiate between avoidance, which is legal, and evasion, which is not, there is no doubt that activity by ratepayers to minimise their liability in ever more inventive ways continues to increase”

Industry Update at Farnham Castle

Find out more about how Councils are addressing business rates fraud at a complimentary Open Day being held on February 7th 2019 at Farnham Castle in Surrey. Just 10 spaces left – More details >